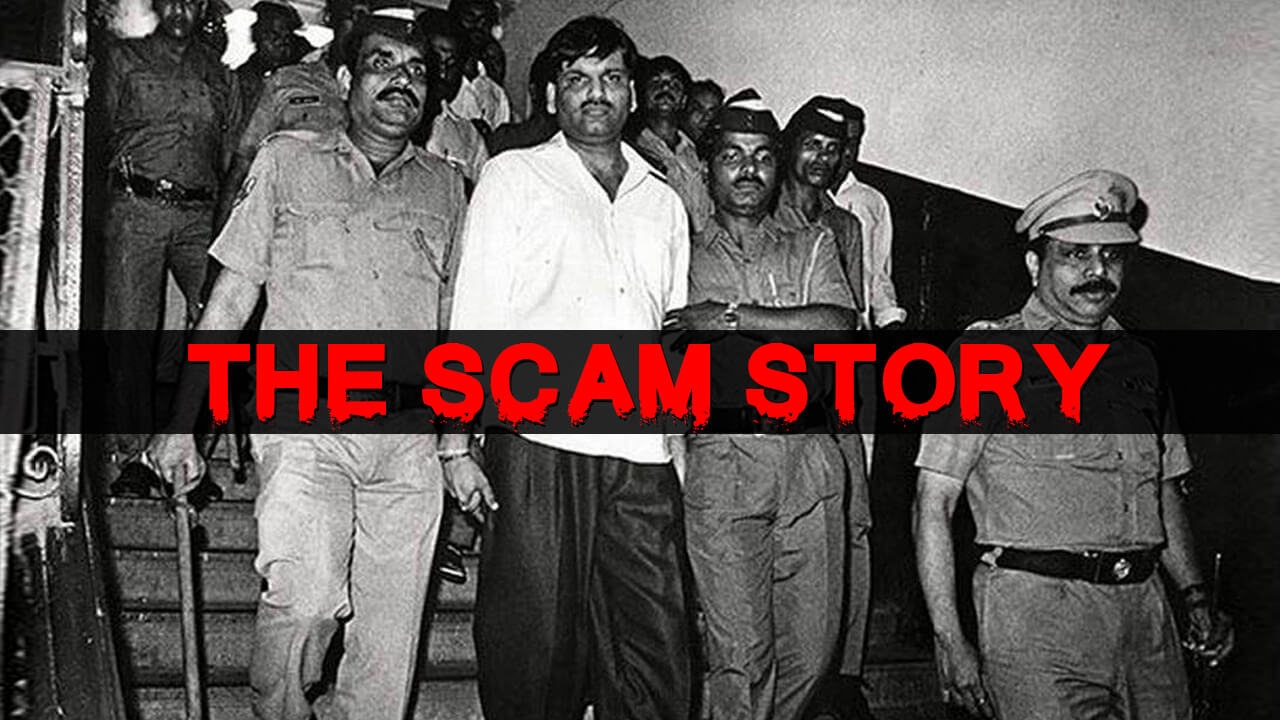

Before Nirav Modi, There Was A Bigger Scam And A Sharper Mind Behind It – Harshad Mehta

I started my career in a financial newspaper, headquartered in Delhi, as a sub-editor. Sitting at one corner and watching the stocks pages getting made, I started taking a modicum of interest in the entire manner. After all, now that I am in it, I should pick up the terms and phrases to get better acquainted with the workload than simply correct the grammar and make pages, I said to myself.

Like every rookie out there, my attention swerved more into the sensational details rather than the everyday dealings of Dalal Street. One name popped up – Harshad Mehta. This tale, which is remembered by only a few in broad details, is in itself a fascinating study. This was a sensational story way before the sensational stories became a staple. Becoming viral was not a trivial matter in 1992.

We all remember the “Wolf of The Wall Street” by Leonardo Di Caprio, inspired by Jordan Belfort but we often fail to look close at home and see that we have several characters right here. I am not trying to glorify him in any manner; however, what I am, perhaps, trying is to give an insight into what happened here; no matter how murky.

Mild Beginnings Of A National Turmoil

Harshad Mehta had studied in Holy Cross Higher Secondary School, Byron Bazar, Raipur. He quit his job at The New India Assurance Company in 1980 and sought a new one with BSE-affiliated stockbroker P. Ambalal, before becoming a jobber on the BSE for stockbroker P.D. Shukla.

In 1981, Mehta became a sub-broker for stockbrokers J.L. Shah and Nandalal Sheth. Later, having gained a considerable amount of experience as a sub-broker, he teamed up with his brother Sudhir to float a new venture called Grow More Research and Asset Management Company Limited.

When the BSE auctioned a broker’s card, the Mehta duo’s company bid for it with the financial support from J.L. Shah and Nandalal Sheth. Another name that is rumoured to have a crucial hand in Mehta’s scam was Nimesh Shah. However, Shah managed to keep a safe distance from the accusations and is currently known to be a heavy player in the Indian stock market.

Mehta had humble beginnings and before the big reveal, many used to treat him as a poster child for ‘rags to riches’ stories. After all, at his peak, he had earned sobriquets, such as “Big Bull” and “Amitabh Bachchan of the stock market.”

His opulence flashed in his outlandish expenditures and a fleet of cars, which rivalled that of the major industrialists of those days. He had his fingers dipped in all major banks and institutions. Everyone, who was in any way related to the market, used to flock around him for wisecracks or ‘Mehta-ism;’ clamouring to brush off some luck for themselves from Mehta’s immaculately tailored drapes. After all, who doesn’t want to be rich?

Before paying advance income taxes and creating headlines became the monopoly of Indian film stars, Mehta did it. He paid Rs. 26 crores to the Indian government, becoming the biggest individual taxpayer.

The Media Darling – Harshad Mehta And His Majestic Luxuries

He used to regularly autograph his name on cheques worth crores to take care of his stock purchases along with that of his admirers. The media also lapped him up; they covered the man, his wit and his majestic abode at Mumbai’s Worli Seaface area, a 15,000 sq ft nest complete with its own mini theatre and golf course.

Mehta had a nice little trick up his sleeve. He was taking money from the banking system and injecting the same into the Bombay Stock Exchange, buying up the stocks that he preferred. As it was expected, investors started targeting stocks, which Mehta bought and this put the stock market on an overdrive.

There was a meteoric rise. Within April 1991 and April 1992, the Sensex moved from 1,194 points to a staggering 4,467, yielding 274% returns. Everyone was ecstatic; until it came to light the Mehta had brought this run by shorting government securities. The market went down by 72% immediately and the bearish phase began; one that lasted for two long years.

By that time the media had sensationalized the case so much that no commoner wanted to touch the stock market even with a 10-foot pole for the next two years.

Even after his apprehension, he was jubilant. As Sucheta Dalal, the journalist who broke the story wrote in her website –

“In June 1992, when he was released after 107 days in custody, he told me ‘Congratulations, you have broken the story of the decade’. That was Harshad again – willing to revel even in negative publicity. He made a triumphant exit from the court, a la Laloo Yadav’s recent jail yatra, amidst a mob of cheering and slogan-shouting investors, who wanted him back in the market, igniting another never-ending bull run.”

Legal Assets And The Issue Of Copy Cats – Harshad Mehta Faces Ketan Parekh

Mehta pulled an impressive line of lawyers for his defence and one Ram Jethmalani to handle all his cases. Till today, the slog is carried on by his family members. Mehta passed away in 2001, not before living behind an explosive declaration that he had donated Rs 1 crore to the then Prime Minister PV Narasimha Rao and the Congress party to make it all go away. That was a brief episode when he had revived himself as a market maverick and he found a copycat in Ketan Parekh, whose scam was closely followed.

Incidentally, while writing this article, the story of Nirav Modi broke out. Switching through channels, I grimaced wondering that even after so many years; the sum total of the banking system’s learning has been; what we Indians take credit for discovering, ‘zero’. Modi used letters of undertaking (LoU), signed by “low level” bank authorities to carry on his fraud for years at end and nobody could catch him.

Now that it has been exposed, he is no longer on Indian soil. I know; I know the media would love to point fingers at the figureheads, as it makes for more sensational headlines.

However, if someone crunches through the data and knocks enough doors, it shouldn’t be hard for him/her to see that our banking system is actually very frail from the inside. So, it doesn’t take much to shake its grounds. A nationalised bank will never go under because it’s the state’s prerogative to insulate it from downfall and if our history can be leafed through, we will see that there have been very small numbers of culprits, who have actually gone through rigorous prison sentences.

When someone commits a murder, it’s easy to pin the blame. However, in a financial crime, many fail to comprehend how the trickledown effect reaches them. A Mehta, a Mallya, a Roy or a Modi is not something that one should read in newspapers and brush it aside because one can’t see the immediate effect of it.

The economy, as a whole, is crumbling and we are watching it as passive bystanders; saying to ourselves that this doesn’t concern us. What we fail to comprehend is the fact that a Mehta happened because the system left a loophole; a Modi happened because the system left a loophole!